Fibank Connector - Making sense out of my banking transactions

In this blog post, I would like to share a connector to the Fibank platform exporting historical transactions, thus allowing me to easily feed transaction data into other software (Airtable, Google Spreadsheets, Odoo) and analyze it.

Why do I need a separate connector? Because the Fibank reporting has a few limitations.

- It is impossible to filter a date ranger bigger than 30 days

- One cannot filter by transaction type, party, etc

- The platform doesn’t provide capabilities to export all transactions to a machine-readable format

- By reverse-engineering their API, I realized it provides valuable information not visible in their UI

- The connector would allow me to further enrich the transaction payload and adapt it to my needs

Reverse-engineering the authentication

The authentication flow is a weird stateful mixture of OAuth2 with a session-based authentication. It uses HTML, JSON, and HTTP headers for transfer purposes. Check the following sequence diagram.

After parsing the access token from the redirect, you can use it for further authentication to the FiBank API. Check the auth implementation of the connector.

Connecting to the API

For the use case of our connector, we are going to use the following authenticated endpoints:

GET sywspicklist/sywspicklist/getFilteredAccounts- returns all accounts with the corresponding IBANGET sywsquery/sywsquery/GetCustBal?FromDate=<date>&ToDate=<date>&Iban=<iban>&StmtType=T&isAccountFromPSD2=false- returns all transactions in the given timeframe

To authenticate we use the previously obtained access_token. Check the connector client implementation here.

Reconciling the transactions to a local DB

Now that we have the basic primitives to communicate with the Fibank API, we can prepare the engine to reconcile the transactions within the connector DB.

class Engine:

def __init__(self):

auth = Auth(settings.FIBANK_USERNAME, settings.FIBANK_PASSWORD)

self._client = Client(auth)

def reconcile_all(self):

self.reconcile_accounts()

self.reconcile_transactions()

def reconcile_accounts(self):

accounts = self._client.get_filtered_accounts()

for account in accounts:

# store account in DB

def reconcile_transactions(self):

for db_account in Account.objects.all():

customer_balance = self._client.get_customer_balance(db_account.iban)

statement = customer_balance['acc'][0]['stmt']

for transaction in statement:

# store transaction in DB

Now, as the transaction data is in our control, we could analyze it. Let’s use SQL for this purpose.

$ mysql -u fibank -p -h localhost fibank

mysql> select count(*) from transaction_transaction;

+----------+

| count(*) |

+----------+

| 2837 |

+----------+

1 row in set (0.01 sec)

Exposing the transaction data via HTTP

I also decided to expose the transaction data via HTTP to integrate easily with Airtable.

def all_transactions(request):

# Make sure to handle authentication

transactions = Transaction.objects.all().order_by('time')

return JsonResponse({

'result': [serialize_tx(tx) for tx in transactions]

})

Deploying the connector to Heroku

Now we are ready to find a home for the connector. I have chosen Heroku due to the simplicity of spinning out a service there. The Procfile is as simple at this:

web: python manage.py runserver 0.0.0.0:$PORT

clock: python clock.py

For simple authentication purposes, the connector uses a randomly generated UUID. Generate one and store it in the AUTH_SECRET environment variable. The e-banking username and password go to FIBANK_USERNAME & FIBANK_PASSWORD.

We have a web process running the webserver. The clock process periodically connects to the e-banking platform and reconciles the transactions. The actual process of deploying the service to Heroku is outside the scope of this blog post, as you could find this information elsewhere.

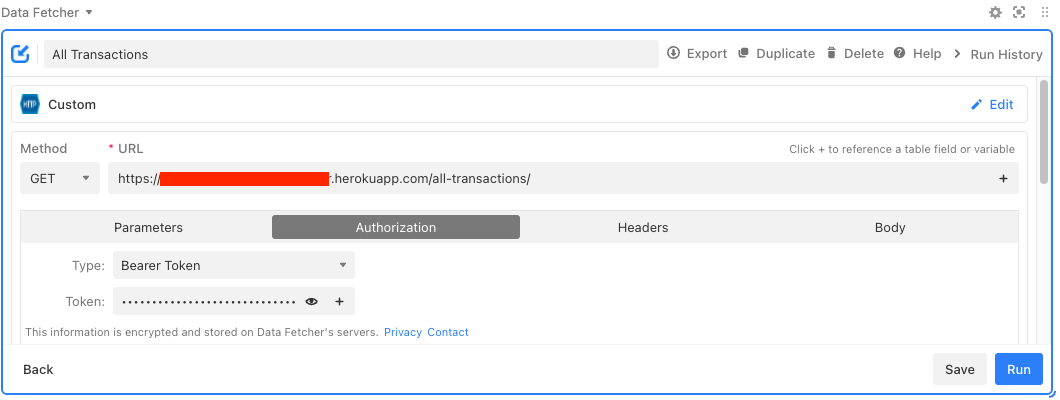

Integrating the connector with Airtable

In this case, I’m integrating with Airtable. Of course, you can integrate with any tool that you’d like. You can achieve a similar result with other software.

- Create a workspace and a table within it

- Use Data Fetcher to feed the transaction data from

https://<your_app>.herokuapp.com/all-transactions/, make sure to pass the authorization token

- Run the request and populate the table

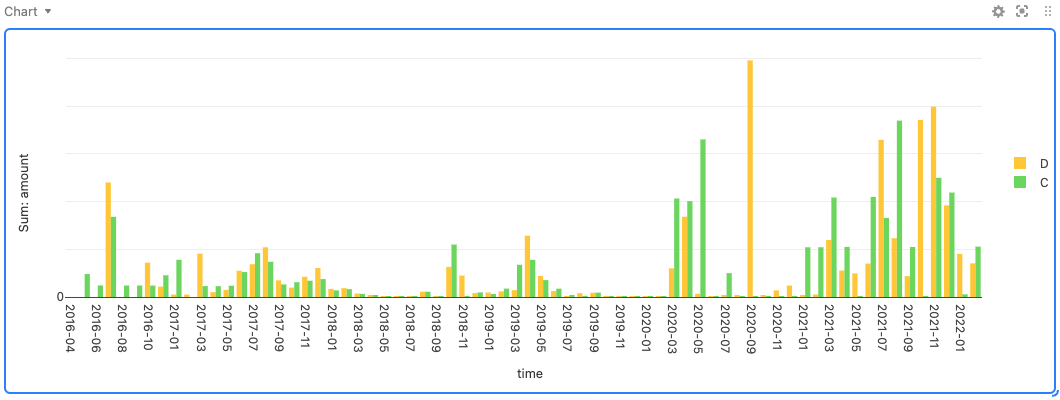

- Now that you have the data populated in Airtable, you can generate charts similar to this one (debit vs credit):

- You can filter by transaction type, group by vendor, have better visibility on how much you spend in fees. This approach could help you to analyze your banking transactions.

Conclusion

Even though this post presents the Fibank connector that I prepared, the approach would be similar for any other e-banking system. Let’s generalize it as follows: 1) connect to the API, 2) reconcile the transactions, 3) re-expose the data in order to analyze it in other software, or simply use SQL to query it.